Key Takeaways:

Big Cities vs. Suburbs:

While big cities like Tampa and St. Petersburg are seeing longer ADOM, suburbs like Riverview, Brandon, and Lithia are experiencing lower ADOM and steady rental increases.

Economic Factors:

Inflation and job market conditions will continue influencing rental prices and demand.

Quality of Schools:

Areas with high-quality schools will remain attractive to families, driving rental demand and prices.

As we move through the summer of 2024, the real estate investing landscape in Tampa Bay is witnessing notable shifts. Rising rental prices, fluctuating average days on market (ADOM), and changing rental dynamics in both big cities and suburbs are causing investors and property managers to stay informed to maximize their returns.

Led by Dave Sigler, a seasoned expert in Florida’s real estate and property management sector, Vintage Real Estate Services (VRE) continues to provide unparalleled insights and services to clients in the region. Here’s a comprehensive look at the market's current state, backed by our internal data and observations from the first half of 2023 and 2024.

Addressing Concerning Trends in Florida's Rental Market

Acknowledging broader market trends and data is important, even if they may not align perfectly with our internal findings. By openly discussing current market conditions and how they impact our strategy, we demonstrate our commitment to transparency and ensure our clients are well-informed. This approach helps set realistic expectations and reinforces the trust our clients place in us.

A recent report from Redfin states that the median asking rent “in America rose 0.7% year over year … Florida is bucking the national trend. The Sunshine State’s four most populous metro areas are seeing rent prices decline.” According to the report, Jacksonville saw a 12.4% year-over-year drop in median asking rent for apartments in June, Tampa experienced a 6% decline, Orlando's rents fell by 4.8%, and Miami's by 3.8%. Redfin attributes this trend to an oversupply of new apartments and competitive pricing among property owners.

Our Unique Findings

Despite the broader trend of declining rents, our internal data shows a more nuanced picture of the Tampa Bay area. VRE’s strategic approach has led to better-than-average performance in certain markets, which is a testament to our expertise and proactive management strategies.

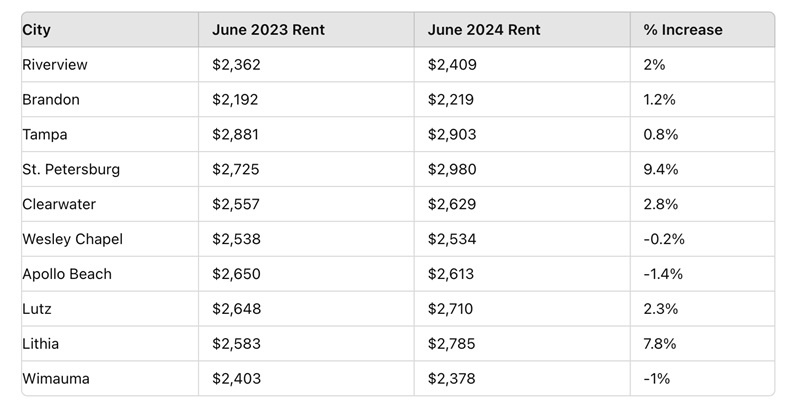

The rental market in Tampa Bay among our customer base has seen a general uptick in prices across various cities. The table below summarizes the year-over-year changes:

While some areas, like Wesley Chapel and Apollo Beach, experienced slight decreases in rental prices, other regions, like St. Petersburg and Lithia, saw significant increases. This highlights the diverse and dynamic nature of the Tampa Bay rental market.

Shifts in Average Days on Market (ADOM)

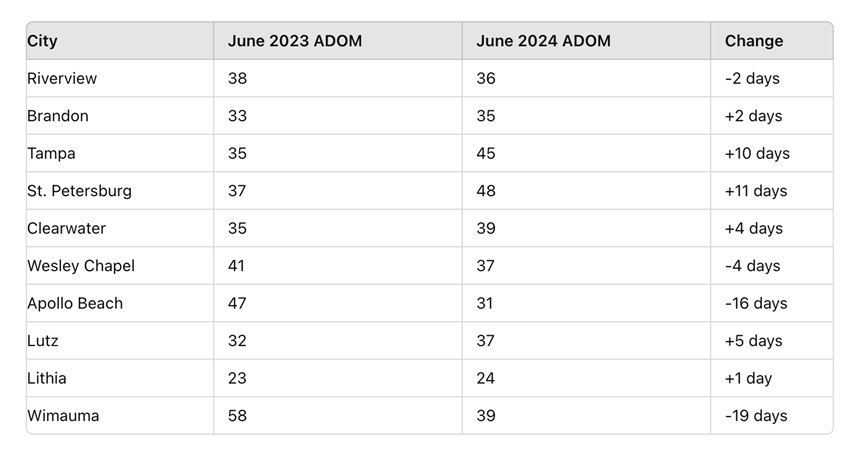

Another critical metric is the Average Days on the Market (ADOM), which reflects how long rental properties stay vacant before being leased. Here’s a breakdown of ADOM for the same periods:

Notably, big cities like Tampa and St. Petersburg have seen substantial increases in ADOM, indicating a slower rental market compared to the suburbs. In contrast, areas such as Apollo Beach and Wimauma have experienced significant decreases in ADOM, making them more attractive for investors looking for quicker tenant turnover.

Factors Influencing Market Dynamics

Several factors contribute to these market dynamics, including location, quality of schools, tenant demographics, and of overall economic conditions.

Location and Quality of Schools

High-quality schools remain a major draw for families and young professionals, impacting rental prices and ADOM. For instance, Lithia, home to some of the best schools in the area, has seen a steady ADOM and a 7.8% increase in rental prices year-over-year.

Tenant Demographics

The type of tenants attracted to specific areas also plays a role. For example, suburban areas like Riverview and Brandon attract more families and young couples, leading to lower ADOM and steady rental increases. In contrast, urban areas like Tampa and St. Petersburg, which attract a mix of professionals and transient populations, are seeing longer ADOM.

Economic Conditions

The broader economic conditions influence rental dynamics, including inflation and the job market. While Tampa Bay remains a competitive rental market, with an overall Rental Competitiveness Index (RCI) score of 76.1, economic factors like job growth and inflation also play a significant role.

Market Predictions for 2024-2025: Real Estate Investing and Property Management in Tampa Bay, Florida

Based on the data points and trends from the first half of 2023 and 2024, we can anticipate several key developments in the market for the rest of 2024 and into 2025:

Continued Demand for Suburban Rentals

Prediction: The demand for suburban rentals will continue to rise. We expect the ADOM in these areas to remain low or decrease further as more renters move away from the city center. Rental prices will likely see a modest increase as demand outpaces supply, especially in high-demand areas like Lithia, known for its top-tier schools.

Stabilization of Urban Rental Markets

Prediction: The urban rental market will stabilize as the influx of new apartments and rental properties catches up with demand. We anticipate the ADOM in cities like Tampa and St. Petersburg to stabilize or even decrease slightly as the market adjusts. Rental prices are likely to remain stable or see marginal increases as the supply of urban housing balances with demand.

Impact of School Quality on Rental Demand

Prediction: Areas with reputed schools will continue to attract renters, maintaining low ADOM and potentially experiencing higher rental price increases. Investors and property managers should prioritize properties in these areas to capitalize on the sustained demand driven by families prioritizing education.

Increased Lease Renewals and Tenant Retention

Prediction: Lease renewals and tenant retention rates will remain high, contributing to lower vacancy rates and more stable rental income for property owners. Property managers should focus on tenant satisfaction and renewal incentives to maintain high retention rates and reduce turnover costs.

Evolving Tenant Demographics

Prediction: The demographic shift towards suburban living will continue to grow. Property managers and real estate investors should cater to this demographic's preferences, such as offering properties with modern amenities, proximity to public transport, and community-centric features. Marketing strategies should highlight these benefits to attract and retain these tenants.

Economic Factors and Rental Price Adjustments

Prediction: Rental prices will continue to be influenced by broader economic factors. We expect moderate rental price growth in most areas, with potential spikes in high-demand suburbs. Property managers should stay informed about economic trends and adjust rental prices strategically to remain competitive while ensuring profitability.

Technological Integration in Property Management

Prediction: The adoption of technology in property management will accelerate. Tools for online rent payment, maintenance request tracking, virtual tours, and tenant screening will become standard. Property managers who embrace these technologies will see improved operational efficiency and tenant satisfaction, leading to higher renewal and lower vacancy rates.

Strategic Real Estate Investing Recommendations

Based on these predictions, here are some strategic recommendations for real estate investors and property managers in Tampa Bay:

Invest in Suburban Areas: Focus on acquiring and managing properties in high-demand suburban areas with good schools and community amenities.

Enhance Tenant Retention: Implement tenant satisfaction programs and offer lease renewal incentives to maintain high retention rates.

Leverage Technology: Adopt advanced property management technologies to streamline operations and enhance tenant experiences.

Monitor Economic Trends: Stay informed about economic conditions and adjust rental prices strategically to stay competitive.

Market to Evolving Demographics: Tailor marketing strategies to appeal to Millennials and older Gen Zers who prefer suburban living with urban amenities.

Focus on Quality Education Areas: Prioritize properties in areas with reputable schools to attract long-term family tenants.

By understanding and leveraging these insights, real estate investors and property managers can confidently navigate the evolving Tampa Bay rental market and maximize their returns.

For further insights and expert guidance on navigating the Tampa Bay real estate market, contact Vintage Real Estate Services (VRE). Our team is here to help you make informed decisions and achieve your investment goals.

David Sigler is a Florida native who grew up in Fort Lauderdale Florida. He attended the University of Central Florida where he received his bachelor’s degree in Business Administration. David has since become a licensed General Contractor & Real Estate Broker. He has been active in Florida real estate and construction for over 15 years. During the Great Recession he was forced to refocus his ambitions and landed on property management. Starting with a handful of homes that could not be sold, he grew his portfolio and eventually bought the brokerage. With his experience, knowledge, and resources, his company prides themselves on successful turn-key residential investment solutions. He now manages hundreds of homes covering 5 counties and his construction company provides maintenance services to his management company as well as other local managers. David is an active member of the National Association Residential Property Managers and has served on the Florida State Board for over 6 years in many different roles; most recently as the NARPM Florida Chapter President (2019). Active in the GTR community, he has served on the property management subcommittee for over 4 years and recently as chair of the group. He is also active in local and state legislation that affects the property management industry. His unique understanding and perspective of property management and its associated maintenance has provided him with numerous public speaking opportunities. Outside of work, not only is he an avid outdoors man and a board member for several local Non-Profit organizations, but first and foremost a Father and Husband.

David Sigler is a Florida native who grew up in Fort Lauderdale Florida. He attended the University of Central Florida where he received his bachelor’s degree in Business Administration. David has since become a licensed General Contractor & Real Estate Broker. He has been active in Florida real estate and construction for over 15 years. During the Great Recession he was forced to refocus his ambitions and landed on property management. Starting with a handful of homes that could not be sold, he grew his portfolio and eventually bought the brokerage. With his experience, knowledge, and resources, his company prides themselves on successful turn-key residential investment solutions. He now manages hundreds of homes covering 5 counties and his construction company provides maintenance services to his management company as well as other local managers. David is an active member of the National Association Residential Property Managers and has served on the Florida State Board for over 6 years in many different roles; most recently as the NARPM Florida Chapter President (2019). Active in the GTR community, he has served on the property management subcommittee for over 4 years and recently as chair of the group. He is also active in local and state legislation that affects the property management industry. His unique understanding and perspective of property management and its associated maintenance has provided him with numerous public speaking opportunities. Outside of work, not only is he an avid outdoors man and a board member for several local Non-Profit organizations, but first and foremost a Father and Husband.