If you're a real estate investor looking for a strategic way to build wealth, you've probably heard of the BRRRR method. Short for Buy, Rehab, Rent, Refinance, Repeat, this investment strategy is popular among investors focused on scaling their rental property portfolios quickly and efficiently. Is the BRRRR method still an effective approach in 2025?

Understanding the BRRRR Method

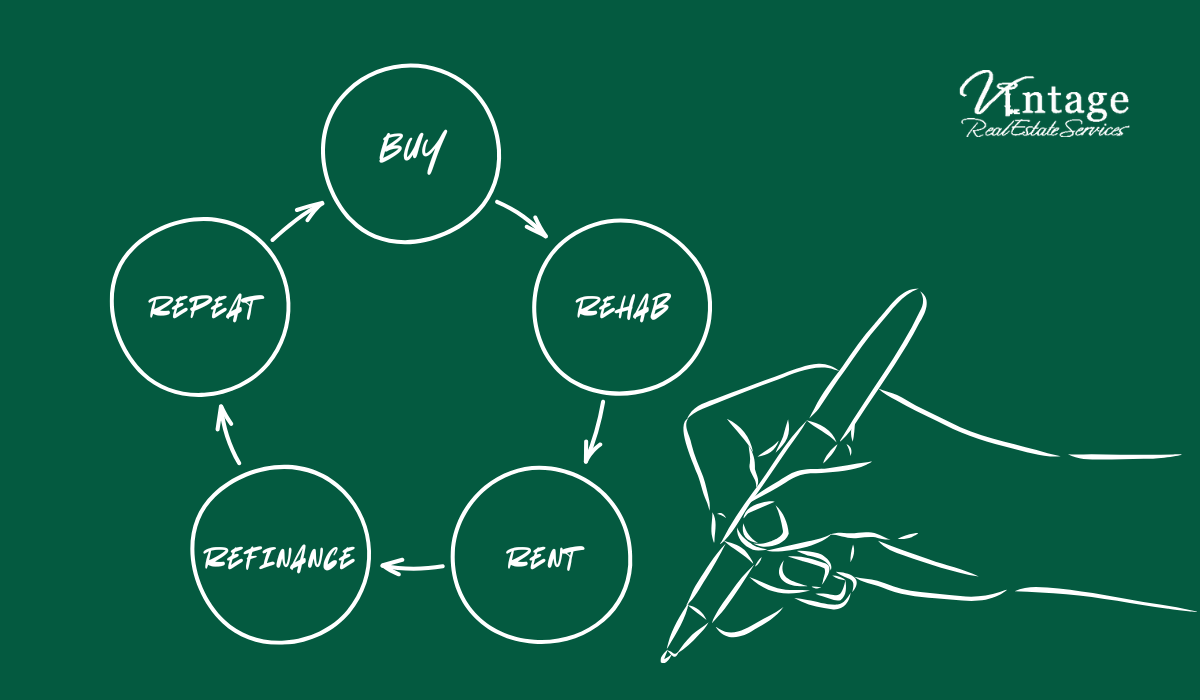

The BRRRR method follows a systematic investment cycle:

Buy – Purchase a distressed or undervalued property at a low price.

Rehab – Renovate the property to increase its value and rental appeal.

Rent – Secure tenants to generate consistent rental income.

Refinance – Take out a new loan based on the improved property value, recouping your initial investment.

Repeat – Use the refinanced capital to purchase another property and start the cycle again.

The key advantage of BRRRR is that it allows investors to recycle their initial capital, enabling them to expand their portfolios quickly with minimal upfront cash required after the first deal.

How Vintage Real Estate Services Makes The BRRRR Method Seamless

At Vintage Real Estate Services, we provide a one-stop real estate investment solution for the Greater Tampa Bay region that simplifies and enhances the BRRRR process. Led by Dave Sigler, our model combines expert property acquisition, tenant placement, and management through Vintage Real Estate Services. At the same time, our sister company, South Shore Contracting, handles the renovation and rehab work. This streamlined approach allows us to work closely with our network of financing partners, contractors, and property managers, ensuring a seamless investment experience with fewer obstacles and inefficiencies. Investors benefit from a well-coordinated team that is highly experienced in working together to maximize returns and create a frictionless investing process.

How Effective is The BRRRR Method in 2025?

Challenges Investors Face Today

While the BRRRR method has been a staple of real estate investing, 2025 presents unique challenges that investors must navigate:

Higher Interest Rates: The Federal Reserve’s monetary policies have elevated mortgage rates, making refinancing more expensive than in previous years.

Increased Property Prices: Home values in Tampa Bay and other high-demand areas have surged, making it harder to find undervalued properties.

Stricter Lending Standards: Lenders are tightening their criteria for cash-out refinances, requiring higher credit scores and stronger financials.

Rising Construction & Labor Costs: The cost of rehabbing properties continues to rise due to supply chain issues and increased demand for skilled labor.

Opportunities for Success with a Turnkey Approach

Despite these challenges, The BRRRR Method remains viable when executed strategically. Investors who work with Vintage Real Estate Services and South Shore Contracting together gain a substantial edge in the market because:

We Source the Best Investment Properties – Our team identifies and secures high-potential properties in Tampa Bay’s emerging neighborhoods before they hit the open market. Remember - we’re local, and we live here!

We Oversee Cost-Effective Rehabs – With South Shore Contracting in our family of companies, we handle renovations as cost-effectively as possible while maintaining a high quality of construction work.

We Streamline Tenant Placement & Management – Our property management expertise ensures you place good, reliable tenants and have a low-stress landlord experience.

We Work with Trusted Financing Partners – Our long-standing lender relationships help investors access financing and keep The BRRRR Method cycle moving smoothly.

Is The BRRRR Method Still Worth It?

The BRRRR method is not as easy or lucrative as it was during low-interest rate periods, but it remains a solid strategy when executed with the right team. Success in 2025 requires:

Smart and swift property selection to maximize value-add potential.

Cost-Efficient renovations to minimize costs and time on the market.

Strategic financing to secure the best possible lending terms.

Expert property management to ensure cash flow for your next investment.

At Vintage Real Estate Services, we partner with investors from start to finish, making real estate investing in Tampa Bay as seamless and profitable as possible. Our unique business model eliminates common obstacles, allowing you to focus on scaling your portfolio while we handle the details.

Ready to Invest Smarter?

If you’re considering the BRRRR method in 2025, let’s talk about how we can support your real estate investment journey. Contact Vintage Real Estate Services today to learn how we can help you grow your portfolio while minimizing risk and maximizing returns.

Why Choose Vintage Real Estate Services?

A Fully Integrated Investment Experience – We find, rehab, tenant, and manage properties under one streamlined process with South Shore Contracting and our financing partners.

Industry Expertise – Led by Dave Sigler, a respected voice in Tampa Bay’s real estate industry.

Comprehensive Solutions – From acquisition to management, we handle it all.

Local Market Mastery – We know the best investment opportunities in Tampa Bay.

Let’s build your wealth the right way. Get in touch today!

David Sigler is a Florida native who grew up in Fort Lauderdale Florida. He attended the University of Central Florida where he received his bachelor’s degree in Business Administration. David has since become a licensed General Contractor & Real Estate Broker. He has been active in Florida real estate and construction for over 15 years. During the Great Recession he was forced to refocus his ambitions and landed on property management. Starting with a handful of homes that could not be sold, he grew his portfolio and eventually bought the brokerage. With his experience, knowledge, and resources, his company prides themselves on successful turn-key residential investment solutions. He now manages hundreds of homes covering 5 counties and his construction company provides maintenance services to his management company as well as other local managers. David is an active member of the National Association Residential Property Managers and has served on the Florida State Board for over 6 years in many different roles; most recently as the NARPM Florida Chapter President (2019). Active in the GTR community, he has served on the property management subcommittee for over 4 years and recently as chair of the group. He is also active in local and state legislation that affects the property management industry. His unique understanding and perspective of property management and its associated maintenance has provided him with numerous public speaking opportunities. Outside of work, not only is he an avid outdoors man and a board member for several local Non-Profit organizations, but first and foremost a Father and Husband.

David Sigler is a Florida native who grew up in Fort Lauderdale Florida. He attended the University of Central Florida where he received his bachelor’s degree in Business Administration. David has since become a licensed General Contractor & Real Estate Broker. He has been active in Florida real estate and construction for over 15 years. During the Great Recession he was forced to refocus his ambitions and landed on property management. Starting with a handful of homes that could not be sold, he grew his portfolio and eventually bought the brokerage. With his experience, knowledge, and resources, his company prides themselves on successful turn-key residential investment solutions. He now manages hundreds of homes covering 5 counties and his construction company provides maintenance services to his management company as well as other local managers. David is an active member of the National Association Residential Property Managers and has served on the Florida State Board for over 6 years in many different roles; most recently as the NARPM Florida Chapter President (2019). Active in the GTR community, he has served on the property management subcommittee for over 4 years and recently as chair of the group. He is also active in local and state legislation that affects the property management industry. His unique understanding and perspective of property management and its associated maintenance has provided him with numerous public speaking opportunities. Outside of work, not only is he an avid outdoors man and a board member for several local Non-Profit organizations, but first and foremost a Father and Husband.